Tax Reform

Navigating the uncertain fates of Build Back Better and key tax issues

Uncertainty about significant tax changes proposed in the Build Back Better bill require attention and action from taxpayers.

Uncertainty about significant tax changes proposed in the Build Back Better bill require attention and action from taxpayers.

The IRS released a memorandum and FAQs to provide procedural guidance regarding R&D credit refund claims on amended tax returns.

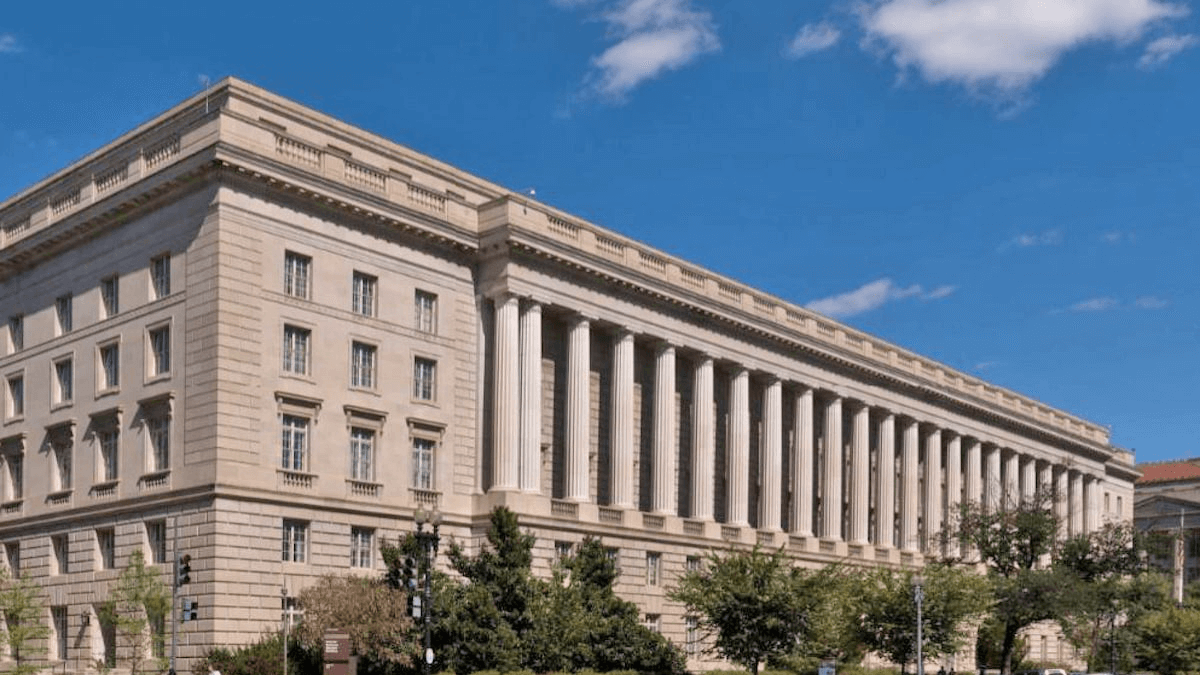

The IRS is tackling identity theft by using ID.me verification technology to guard access to online services.

National Taxpayer Advocate, Erin Collins, recommends the IRS pause automated collection notices. Congress may consider the recommendation.